Module 2 employment and taxes everfi answers – Embark on a comprehensive journey through module 2 of Everfi’s employment and taxes curriculum, where you’ll uncover essential knowledge to navigate the complexities of the workplace and financial responsibilities. Our in-depth guide provides clear and concise answers to empower you with a solid understanding of employment types, tax withholdings, paycheck analysis, and effective financial management.

Types of Employment

There are several different types of employment, each with its own advantages and disadvantages. The most common types of employment include:

Full-Time Employment

- Typically involves working 40 hours or more per week.

- Employees are typically eligible for benefits such as health insurance, paid time off, and retirement plans.

- Provides a steady income and can offer opportunities for career advancement.

Part-Time Employment

- Typically involves working less than 40 hours per week.

- Employees may or may not be eligible for benefits.

- Offers flexibility and can be a good option for students, parents, or those with other commitments.

Temporary Employment

- Involves working for a specific period of time, typically less than one year.

- Employees may or may not be eligible for benefits.

- Can provide flexibility and the opportunity to gain experience in different fields.

Contract Work

- Involves working on a specific project or task for a defined period of time.

- Contractors are typically self-employed and responsible for their own taxes and benefits.

- Offers flexibility and the opportunity to set your own hours.

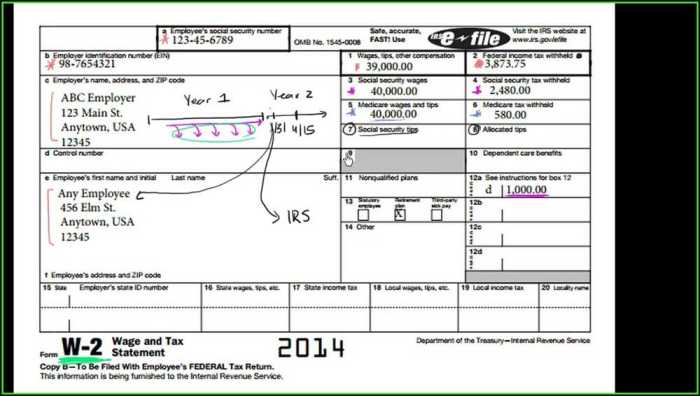

Taxes and Withholdings

When you earn income, taxes are withheld from your paycheck. The most common types of taxes withheld include:

Federal Income Tax, Module 2 employment and taxes everfi answers

- Calculated based on your taxable income, which is your total income minus certain deductions and exemptions.

- The amount of federal income tax withheld depends on your filing status, income, and the number of allowances you claim on your W-4 form.

- Progressive tax, meaning the more you earn, the higher the tax rate.

Social Security Tax

- Funds the Social Security program, which provides retirement, disability, and survivor benefits.

- Withheld at a rate of 6.2% on the first $147,000 of income.

- Self-employed individuals pay both the employee and employer portions of Social Security tax.

Medicare Tax

- Funds the Medicare program, which provides health insurance for seniors and people with disabilities.

- Withheld at a rate of 1.45% on all income.

- Self-employed individuals pay both the employee and employer portions of Medicare tax.

Paycheck Analysis

Your paycheck is a statement of your earnings and deductions for a specific pay period. It typically includes the following sections:

Gross Pay

- Your total earnings before any deductions are taken out.

- Includes wages, bonuses, and commissions.

Deductions

- Taxes withheld from your paycheck, such as federal income tax, Social Security tax, and Medicare tax.

- Other deductions, such as health insurance premiums, retirement contributions, and union dues.

Net Pay

- Your take-home pay after all deductions have been taken out.

- The amount of money you actually receive in your paycheck.

Managing Your Finances

Managing your finances is essential for financial security. Here are some tips for managing your money:

Budgeting

- Track your income and expenses to see where your money is going.

- Create a budget that allocates your income to different categories, such as housing, food, and transportation.

- Stick to your budget as much as possible.

Saving

- Set up a savings account and make regular deposits.

- Take advantage of employer-sponsored retirement plans, such as 401(k)s and IRAs.

- Consider setting up a separate savings account for emergencies.

Investing

- Invest your money to grow your wealth over time.

- Consider a diversified portfolio of stocks, bonds, and mutual funds.

- Get professional advice if you need help managing your investments.

Additional Resources: Module 2 Employment And Taxes Everfi Answers

Here are some additional resources on employment and taxes:

- Internal Revenue Service (IRS): https://www.irs.gov/

- Social Security Administration (SSA): https://www.ssa.gov/

- Department of Labor (DOL): https://www.dol.gov/

- Financial Literacy and Education Commission (FLEC): https://www.flec.gov/

Essential Questionnaire

What are the different types of employment?

Module 2 classifies employment into four main categories: full-time, part-time, temporary, and contract work, each with its unique characteristics and implications.

How are taxes calculated and withheld from my paycheck?

Everfi explains the process of tax withholding, covering federal income tax, Social Security tax, and Medicare tax, providing examples to illustrate how these taxes are calculated based on your earnings.

What is the importance of understanding my tax withholding?

Module 2 emphasizes the significance of understanding your tax withholding to ensure accurate deductions, avoid penalties, and plan for tax refunds or payments.